Fifth Third completes merger with Comerica, becomes 9th largest bank

Published in Business News

Fifth Third Bancorp said Monday it has completed its merger with Comerica Inc., creating the nation’s ninth-largest bank.

In the fall, Cincinnati-based Fifth Third had agreed to acquire Detroit-founded Comerica in an all-stock deal valued at $10.9 billion. The merger creates a bank with about $294 billion in assets, officials said.

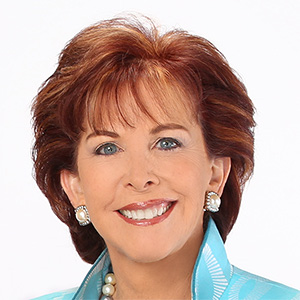

“We are thrilled to announce we have closed our merger with Comerica,” Tim Spence, chairman, CEO and president of Fifth Third, said in a statement. “This combination marks a pivotal moment for Fifth Third as we accelerate our strategy to build density in high-growth markets and deepen our commercial capabilities. Together, we are creating a stronger, more diversified bank that is well-positioned to deliver exceptional value for our shareholders, customers, communities and teammates — starting today, and over the long-term.”

Officials say the merger with Dallas-based Comerica builds on Fifth Third’s strong momentum entering 2026, following what it calls a year of record revenue, "best-in-class profitability and efficiency, strong loan and deposit growth and continued leadership in digital banking and commercial payments. "

Fifth Third said it is solidifying its leadership in the Midwest while also operating in what it considers 17 of the 20 fastest-growing large markets in the country, including regions in the Southeast, Texas and California. Fifth Third said it plans to have 1,750 branches by 2030, with more than half in the Southeast, Texas, Arizona and California.

In recent weeks, Comerica employees have experienced layoffs as the deal neared completion. According to LinkedIn posts, layoffs affected corporate roles in Michigan and other states.

Comerica said it was providing resources to support impacted employees during the transition and remained focused with Fifth Third on building the combined organization.

Officials say the combined company now has two $1 billion recurring and high-return fee businesses: commercial payments and wealth and asset management.

Comerica has 143 banking centers in Michigan, including 115 in Metro Detroit, while Fifth Third has 163 branches statewide, 59 in the region.

The merger will result in some bank branch closures as well as changes to the Comerica corporate offices in downtown Detroit. About 55 Comerica branches and 21 Fifth Third locations in Michigan are expected to close, according to documents posted by Fair Finance Watch that were obtained through a Freedom of Information Act request. Fifth Third said it did not expect branch closures until the second half of 2026.

Comerica branches will be rebranded under the Fifth Third name. Officials have said change is also expected regarding the naming rights for Comerica Park, home of the Detroit Tigers, possibly as soon as the 2027 season.

Comerica was founded in 1849 in Detroit as the Detroit Savings Fund Institute. It went through several name changes and mergers over the years, becoming Comerica Inc. in 1982. A 1992 merger with Manufacturers National Corporation made it one of the nation’s largest bank holding companies. In 2007, Comerica moved its headquarters to Dallas.

©2026 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments