What could a Boeing defense strike mean for the company?

Published in Business News

More than 3,200 Boeing employees at defense division factories in the St. Louis area could walk off the job Sunday, halting production of the aerospace company’s fighter jets.

Members of the Machinists union Local 837 voted Sunday to reject Boeing’s latest contract offer, starting the clock for a seven-day cooling off period before a strike could begin.

The two parties will continue negotiations Thursday, according to a Boeing spokesperson.

While the threatened strike would be disruptive, particularly for an area of Boeing's business already struggling with costly contracts, analysts don’t expect the stoppage would hinder Boeing’s overall financial position.

And it won’t have the same detrimental impact of a 53-day Machinists strike at the company’s Puget Sound-area factories last fall, analysts said.

In that case, 33,000 union members walked off the job, halting production in Boeing’s commercial factories in Renton and Everett. From the time workers left in September to their return in November, Boeing lost at least $5.5 billion, according to an estimate from the consulting firm Anderson Economic Group.

To shore up its finances, Boeing raised $21 billion in an expanded share sale in October, working to stave off a potential credit rating downgrade amid the ongoing labor stoppage.

The strike in St. Louis would impact fewer workers and a smaller portion of Boeing’s inventory, and comes at a time when Boeing is more prepared to weather the impact, said Scott Mikus, an aerospace analyst with Melius Research.

When Machinists walked out of Boeing’s Puget Sound-area factories last fall, the company was still recovering from a panel blowing off an Alaska Airlines 737 MAX 9. The blowout briefly grounded the plane, slowed production in Boeing’s factories and led to heightened regulatory scrutiny as lawmakers and the flying public questioned the company’s manufacturing practices.

“It was just at a really bad time,” Mikus said. “Boeing already had pressure on deliveries, then was trying to regain their footing, and then got hit with the strike.”

Now, almost a year later, “one thing’s for sure: the balance sheet is in much better shape,” Mikus continued.

While a disruption to Boeing’s commercial products quickly affected the company’s ability to make money from delivering planes to customers, the defense business doesn’t account for as much of the company’s revenue, so a strike in its defense factories wouldn’t have an immediate hit.

“Fighter aircraft, at this point, aren’t a huge part of Boeing’s overall revenue exposure,” Mikus said.

In the second quarter this year, Boeing’s defense and space business recorded $6.6 billion in revenue, while its commercial airplanes division recorded $10.9 billion.

During the same quarter last year, months before the Machinist's Puget Sound-area strike kicked off, both Boeing’s defense and commercial business reported $6 billion in revenue.

The strike could impact Boeing’s tentative defense recovery, though, said Ron Epstein, an analyst with Bank of America.

While the division has earned money from its operations the last two quarters, it lost $2.3 billion in the fourth quarter of 2024, reflecting $1.7 billion in write-offs from troubled fixed-price contracts.

Epstein doesn’t expect the work stoppage would impact earnings or free cash flow by a wide margin, but “what it does do, the recovery they’ve been working on … it just pushes all that to the right.”

Epstein and Mikus said the strike would not impact Boeing’s latest defense win: a contract from the U.S. Air Force to build its next fighter jet, the F-47.

Because the contract is so new, and Boeing is just starting to expand operations to accommodate production, a strike right now would likely not delay that timeline, the analysts said.

The strike also would likely not impact two Boeing defense products that are built as derivatives of commercial planes: the KC-46 tanker built in Everett and the P-8 Poseidon built in Renton.

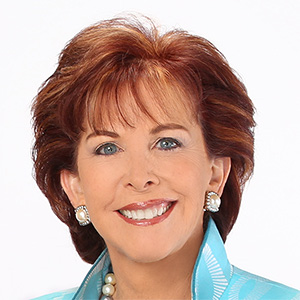

Boeing CEO Kelly Ortberg, who helped usher in a deal to end the Machinists work stoppage last fall, told investors Tuesday he wasn’t concerned about the St. Louis strike.

“The order of magnitude of this is much, much less than we saw last fall,” Ortberg said. “We’ll manage through this. I wouldn’t worry too much about the implications of the strike.”

The proposed offer to Local 837 included a 20% wage increase over the next four years and a $5,000 ratification bonus.

The International Association of Machinists and Aerospace Workers said in a statement the offer “fell short of addressing the priorities and sacrifices of the skilled IAM Union workforce. Our members are standing together to demand a contract that respects their work and ensures a secure future.”

Boeing characterized the proposal as the “richest contract offer we’ve ever presented to IAM 837” and said it was “disappointed” employees had voted against it.

“We’ve activated our contingency plan and are focused on preparing for a strike,” the company said in a statement.

©2025 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments