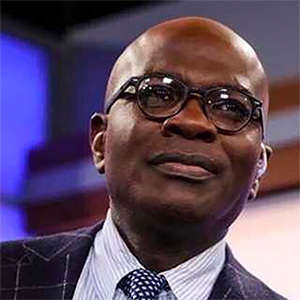

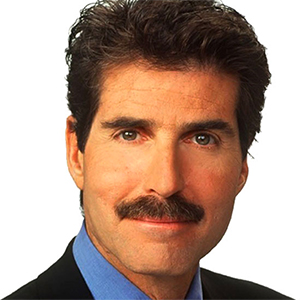

Trump and Fed Chair Jerome Powell meet amid spat over interest rates

Published in Political News

Federal Reserve Chairman Jerome Powell and President Donald Trump met for the first time in the president’s second term and sent mixed messages over their long-running spat over interest rates.

The Fed, in a statement, said the top central banker did not discuss interest rates at the White House meeting with Trump. The president has berated Powell as a “loser” and threatened to fire him for resisting pressure to lower lending rates to juice the sluggish economy.

“Powell did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook,” the statement said.

The pair discussed “economic developments including for growth, employment and inflation,” the Fed statement added.

But White House press secretary Karoline Leavitt said Trump told Powell he should lower rates at the meeting.

“The president did say that he believes the Fed chair is making a mistake by not lowering interest rates,” Leavitt told reporters.

Trump invited Powell, whom he appointed during his first term, to the White House. Despite the split over rates, the apparently cordial meeting could reassure markets by offering a sign that the two leaders are working amicably together to improve the U.S. economy.

Trump has slammed Powell for weeks for not reducing the Fed’s benchmark interest rate as a tool to invigorate the slowing economy by potentially reducing the borrowing costs consumers face for mortgages, cars and credit cards.

The president even suggested he might seek to fire Powell, although most analysts believe he does not have the power to oust the head of the nation’s central bank. After financial markets reacted negatively, Trump backtracked on removing Powell, whose term as chairman ends in May 2026.

The Fed is in a tight spot because it is supposed to simultaneously fight unemployment and keep inflation under wraps. Inflation is down substantially from a year ago, yet it remains above the Fed’s 2% target.

The central bank has kept rates unchanged at several recent monthly meetings, and pundits are split on when or if it might resume rate cuts.

Powell has said Trump’s trade war will likely increase inflation, making it less likely to lower interest rates even if the labor market gets softer, a dreaded economic scenario known as stagflation.

_____

©2025 New York Daily News. Visit nydailynews.com. Distributed by Tribune Content Agency, LLC.

Comments