POINT: Yes, America's national debt is a crisis

Published in Op Eds

In their classic book “This time is different: Eight hundred years of financial folly,” Kenneth Rogoff and Carmen Reinhart found that over the centuries, a high public debt level has been among the most reliable indicators of future financial crises.

It is a pity that Rogoff and Reinhart’s findings seem to have escaped President Donald Trump’s notice. Had he paid heed to the lessons of past public debt crises, he would not have sought passage of his “One Big Beautiful Bill.”

By substantially increasing the country’s future debt level, that piece of legislation has put the country on course for a dollar and Treasury bond market crisis in the run-up to next year’s mid-term election.

Since the Bill Clinton administration, a key economic challenge in our country has been the lack of a political constituency for responsible budget policy. When in office, Democrats have liked to spend but have been loath to raise taxes to pay for that spending.

When in office, Republicans have wanted to cut taxes but have been reluctant to cut spending to fund those tax cuts. The net result has been a lot of budget red ink and an ever-increasing public debt level.

Even before Trump began his second term, the country’s public finances were on an unsustainable path. According to the non-partisan Congressional Budget Office (CBO), last year the budget deficit reached 6¼ percent of GDP. It had done so at a time when the economy was very close to full employment or at a stage of the economic cycle when the country should have been improving its public finances.

Meanwhile, the CBO warned that, absent a correction in budget policy, the public debt in relation to the size of the economy would be on a path to exceed its level at the end of World War II by 2035.

The responsible thing for Trump to have done would have been to address the country’s shaky public finances. He might have done so with some combination of public spending cuts and revenue-enhancing measures along the lines of the 2010 bipartisan Bowles-Simpson Commission.

Instead, he chose to go in the opposite direction by securing passage of his budget-busting One Big Beautiful Bill. That bill included the extension of the 2017 Tax Cut and Jobs Act and the elimination of income taxes on tips, overtime and Social Security benefits. While it did include spending cuts, most notably on Medicaid, those cuts did not go nearly far enough to offset the cost of the tax cuts.

The net result is that the country now has set itself up for a dollar and bond market crisis. According to the CBO, Trump’s budget initiative is projected to add $3.4 trillion to the deficit over the next decade. In turn, that will take the public debt level to a record 124% of GDP by 2034. It is little wonder then that Moody’s has now joined the other major credit rating agencies in cutting America’s coveted AAA bond rating.

A key vulnerability of the United States is its high dependence on foreigners to finance its large budget deficits. One measure of this dependency is that foreigners own almost one-third of the $29 trillion of outstanding U.S. Treasury bonds. This makes it difficult to understand why the Trump administration undermines foreign investor confidence by engaging in budget profligacy, putting intense pressure on the Federal Reserve to cut interest rates aggressively, and periodically intimating that the Treasury will not fully honor its debt obligations.

While the stock market seems to be unfazed by the state of our public finances, early warning signs of trouble ahead are coming from other markets. Since the start of the year, the dollar has depreciated by more than 10%, marking its worst first half-year performance since 1973.

It is concerning that this has happened at a time when we would have expected the dollar to appreciate because of Trump’s import tariffs and a widening of the short-term interest rate differential in our favor.

Meanwhile, bond yields have remained uncomfortably high, even at a time of financial market turbulence, despite the Fed cutting its interest rate by 100 basis points since September. Since the start of 2025, in a sign of waning foreign investor confidence in the dollar, the gold price has increased by more than 25%.

Trump would be well advised to heed these warning signs and make an early budget policy U-turn to avoid a future dollar and bond market crisis. However, I certainly do not recommend holding your breath for that to happen.

_____

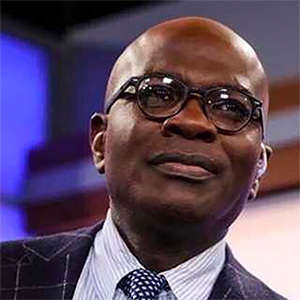

ABOUT THE WRITER

Desmond Lachman is a senior fellow at the American Enterprise Institute. He wrote this for InsideSources.com.

_____

©2025 Tribune Content Agency, LLC

Comments