Colorado's largest independent bank accepts $4.1 billion buyout offer from PNC Financial

Published in Business News

FirstBank, Colorado’s largest privately owned bank, has accepted a buyout offer from PNC Financial Services Group, a large regional bank based in Pittsburgh.

PNC will pay cash and stock worth $4.1 billion for the Lakewood-based bank, which started in 1963 and has grown to $26.8 billion in assets and 95 branches.

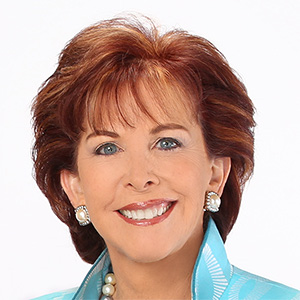

“The opportunity this affords all of our stakeholders — it is very compelling,” said Kevin Classen, FirstBank’s CEO, in an interview.

Across decades, FirstBank’s discipline helped it avoid the excesses that sunk other local rivals. Its independence allowed it to promote strong community ties, including founding Colorado Gives Day, which has generated $500 million in donations for area nonprofits. In 2007, it entered Arizona and established 13 branches in that state.

Classen said it has become harder to keep up with the “technological arms race” the banking industry is engaged in. Providing a more diverse range of services and operating at a larger scale have become more important, but FirstBank didn’t want to merge with just anyone.

PNC Financial, which shares FirstBank’s emphasis on local decision-making and community engagement, represents the right kind of partner to broaden its offerings, especially on the commercial side, Classen said.

“We will remain committed to our principles — ‘Banking for Good,‘ ” said Classen, who will become PNC’s Colorado regional president and Mountain Territory executive responsible for Arizona and Utah once the deal is complete.

PNC was formed in 1983 from the merger of Pittsburgh National Corporation and Provident National Corporation. It has $559 billion in assets and operates about 2,300 branches providing a mix of consumer and commercial banking services. It is smaller than the country’s four biggest banks — Chase, Bank of America, Citigroup and Wells Fargo, but larger than most regional banks, leading some to call it a “super-regional.”

“FirstBank is the standout branch banking franchise in Colorado, with a proud legacy built over generations by its founders, management, and employees,” said William S. Demchak, chairman and CEO of PNC. “Its deep retail deposit base, unrivaled branch network in Colorado, growing presence in Arizona, and trusted community relationships make it an ideal partner.”

PNC entered the Denver market in 2017 and expanded its presence in 2021 with the purchase of Compass Bank, the U.S. arm of Spanish banking giant BBVA.

PNC has 30 branches in Colorado, but its long-term goal has been to operate 200, a goal the FirstBank purchase brings closer to achieving, Demchak said.

The acquisition will vault PNC from the state’s 12th-largest bank in terms of deposits to the second-largest after Wells Fargo, with a network of 120 Colorado branches. PNC will become metro Denver’s largest banking group with 20% of consumer deposits and 13% of branch locations, the bank said.

Denver, in turn, will rank as a top-five market for the bank and one of its largest in terms of the share of consumer deposits. PNC will extend a deeper menu of corporate banking and wealth management services to FirstBank’s existing customers.

“We wouldn’t have done this if we didn’t think we could carry forward (FirstBank’s) strengths,” Demchak said.

FirstBank stands apart from most banks of its size for the large portion of ownership in the hands of management and employees. And when it comes to paying a dividend, it has been consistent.

FirstBank’s current investors will have the choice of taking their payout from either the $1.2 billion cash or 13.9 million shares PNC has set aside. Those who stay on will trade becoming a smaller fish in a much bigger pond — PNC has a market value of $80.5 billion — for the greater liquidity that comes from owning publicly traded shares.

PNC executives said they don’t plan to close any of FirstBank’s branches or reduce its current workforce in Colorado and Arizona.

The bank also plans to continue FirstBank’s practice of funding public investments and philanthropic giving in the community. PNC has invested more than $85 billion, including $3.4 billion in Colorado and Arizona, in affordable housing, economic development and small business support through its Community Benefits Plan. It also has a $500 million initiative called Grow Up Great to prepare children under 5 for school through bilingual education programs and resources.

The purchase should close in early 2026, and once it does, the transition of branches and branding from FirstBank to PNC should occur over a weekend, Demchak said.

©2025 MediaNews Group, Inc. Visit at denverpost.com. Distributed by Tribune Content Agency, LLC.

Comments